KFB Insurance Bill Pay

Kentucky Farm Bureau is a grassroots association committed to serving our participation family and their networks. As the Voice of Agriculture, we distinguish issues, create arrangements, advance monetary achievement, and improve personal satisfaction for all. Kentucky Farm Bureau has set up a standing as a compelling promoter for its individuals. Its data items and part administration programs are additionally all around regarded and profoundly effective.

Programs of Kentucky Farm Bureau Insurance:

- Projects offered incorporate Farm Bureau Insurance, Public Affairs, and other part benefits.

- Ladies’ Leadership Activities, Ag in the Safety, Classroom, Health, and Wellness

- Bequest Planning, Theft Reward, Scholarships, Commodity Market Information, Certified Roadside Farm Markets, and Young Farmers.

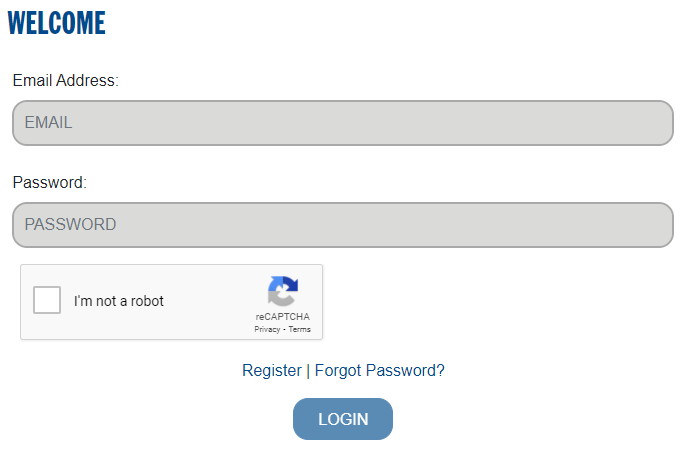

Kentucky Farm Bureau Insurance Online Bill Pay:

- For the online bill payment open the webpage my.kyfb.com

- Once the page appears at the center enter the necessary login information, check the verification box

- Now click on the ‘Login’ button

Reset Kentucky Farm Bureau Insurance Login Credentials:

- To reset the login details open the page my.kyfb.com

- As the page opens at the login homepage hit on the ‘Forgot password?’ button.

- In the next screen provide the account-associated email, check the verification box click on the ‘Send reset’ button.

Register for Kentucky Farm Bureau Insurance Account:

- For the registration of the account open the website my.kyfb.com

- As the page appears on the login homepage hit on the ‘Please click here to register now’ button.

- In the next screen enter the required information hit on ‘Register’ button.

Kentucky Farm Bureau Insurance Bill Guest Pay:

- To pay the bill as a guest open the webpage my.kyfb.com

- After the page opens click on the ‘Please click here to pay as guest’ button.

- On the next screen select your type, enter the number, last name, or company name, check the verification box click on the ‘Next button.

Kentucky Farm Bureau Insurance Bill Pay by Phone:

- You have to pay with the telephone. You can check the number from your bill.

- You have to call on, 1-800-206-6887.

Kentucky Farm Bureau Insurance Bill Pay by Mail:

- You can also pay the bill through the mail. You have to send the bill to a specific address.

- Send it to, PO Box 856045. Louisville, KY 40285-6045.

Kentucky Farm

- Time Period Plan: The death gain from a term plan is only to be had for a designated period, as an example, 40 years from the date of coverage purchase. Existence insurance refers to coverage or cowl whereby the policyholder can make sure monetary freedom for his/her family contributors after dying. Think you’re the sole income member on your circle of relatives, helping your spouse and kids.

- Endowment Plan: Endowment plans are lifestyle insurance rules in which a part of your rates go closer to the demise advantage, while the remaining is invested by means of the coverage company. Maturity advantages, death gain, and periodic bonuses are some types of help from endowment guidelines.

- Unit Connected Coverage Plans: much like endowment plans, part of your coverage charges move toward mutual fund investments, at the same time as the last go in the direction of the loss of life advantage. On such an occasion, your demise could financially devastate the entire own family. Life coverage regulations make certain that this sort of aspect does now not show up by using providing financial assistance to your family on the occasion of your passing.

- Whole Lifestyles Insurance: because the call shows, such policies offer lifestyles cover for the entire existence of a man or woman, as opposed to a certain term. Some insurers may also limit the whole lifestyle insurance tenure to one hundred years.

- Infant’s Plan: funding cum coverage policy, which affords monetary aid to your kids in the course of their lives. The demise benefit is to be had as a lump-sum fee after the death of mother and father.

- Money-Returned: Such guidelines pay a certain percent of the plan’s sum confident after normal periods. That is referred to as a survival benefit.

- Retirement Plan: also referred to as pension plans, these guidelines are a fusion of funding and coverage. A part of the rates is going towards growing a retirement corpus for the policyholder. This is to be had as a lump-sum or month-to-month fee after the policyholder retires.

Read More : How to Pay Greater Ouachita Water Bill

Kentucky Farm Bureau Insurance Contact Details:

If you are looking for more details call on the toll-free number 1-866-532-2524.

Reference Link: