PennyMac Bill

Home credits aren’t one-size-fits-all. Regardless of whether you’re a first-time homebuyer or renegotiating your home to save money on your regularly scheduled installments, PennyMac Loan Services has a wide scope of home loan choices to suit your interesting necessities. See the table underneath to analyze a couple of key segments over a scope of home loan alternatives or, on the off chance that you definitely know the subtleties of what you’re searching for, click the catch to get a redone rate quote.

Why Choose PennyMac:

- A standard mortgage isn’t protected or ensured by the central government, which makes it not the same as projects like USDA, VA, and FHA. These adaptable credits permit borrowers to get low rates and regularly stay away from contract protection with a higher initial installment.

- The Federal Housing Administration contract program is overseen by the Department of Housing and Urban Development, which is a division of the government. While these sorts of advances are normally generally famous with first-time homebuyers, FHA credits are accessible to a wide range of borrowers.

PennyMac Bill Pay:

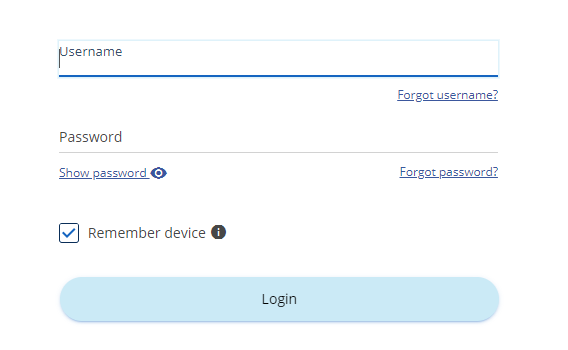

- For the online bill payment open the page www.pennymacusa.com

- As the page opens at the top right click on the ‘Login/register’ button.

- You have to choose your profile and follow the prompts.

PennyMac Bill Pay by Mail:

- You can also pay the bill through the mail. You have to send the bill to the particular address.

- Send it to, Standard Payment Address: PO Box 30597. Los Angeles, CA 90030-0597.

- Overnight Payment Address: Attn: Lockbox Operations POB 30597. 20500 Belshaw Ave. Carson, CA 90746

PennyMac Bill Pay by Phone:

- You must have the payment details and pay the bill through phone number.

- You have to call on, (800) 777-4001.

- You can also call on a Western Union location and pay the bill.

PennyMac Refinancing Options:

- Bringing down your regularly scheduled installment. As indicated by one examination, a normal mortgage holder may save $160 or more every month with a renegotiate. With a lower regularly scheduled installment, you are allowed to put the investment funds toward different obligations and different uses, or apply that investment funds towards your month-to-month contract installment and pay off your advance sooner.

- Eliminate private home loan protection. A few property holders who have enough property thankfulness or chief took care of won’t be needed to pay contract protection which will lessen your complete regularly scheduled installment. Your FICO assessment decides your home loan renegotiate endorsement, yet in addition, decides the financing cost your bank will offer.

- Lessening the length of your advance. For property holders who took out a home loan in the beginning phases of their profession, a 30-year home loan may have seemed well and good. In any case, for the individuals who need to take care of their home loan sooner, diminishing the advance term can be an appealing choice.

- Changing from a flexible rate home loan to a fixed-rate advance. At the point when you have a customizable rate contract, your installment can change up to or down as loan costs change. Changing to a fixed-rate credit with dependable and stable regularly scheduled installments can give mortgage holders the security of realizing that their installment will never show signs of change.

- Uniting your first home loan and your home value credit extension. By folding these into a solitary regularly scheduled installment, you can rearrange your accounts and spotlight one obligation. HELOCs frequently have movable rates, so renegotiating into a fixed-rate advance might set aside your cash over the long haul.

- Utilizing the value in your home to take out money. With rising home estimations, you may have enough value to take out money out renegotiate. This cash can be utilized to back home enhancements, take care of obligations, or subsidize huge buys.

Read More : How to Pay Illuminating Company Bill

PennyMac Customer Information:

For more information call on (888) 870-6229.

Reference Link: